Therefore, being oversold in & of itself should not necessarily be considered a buy signal.RSI Is an Oscillator – Its Purpose Is to Make Things SimpleUsing the Relative Strength Index (RSI) The RSI is a technical analysis momentum indicator which displays a number from zero to 100. Its critical to note that oversold can remain oversold for quite a while. These scans find stocks which can be considered oversold based on Stochastic or by being at or below the lower Bollinger Band.

Oscillators typically transform price information to a stationary scale with fixed limits (e.g. Oscillators are indicators calculated from price and their main purpose is… (no, not to predict the future) … to simplify our view on price action by removing the trend factor. This implies that the RSI can also be used to identify the overbought/oversold levels in a counter.RSI (Relative Strength Index) is one of the most widely used oscillators. Overbought/oversold levels: The RSI value will always move between 0 and 100 the value will be 0 if the stock falls on all 14 days, and 100, if the price moves up on all the days).

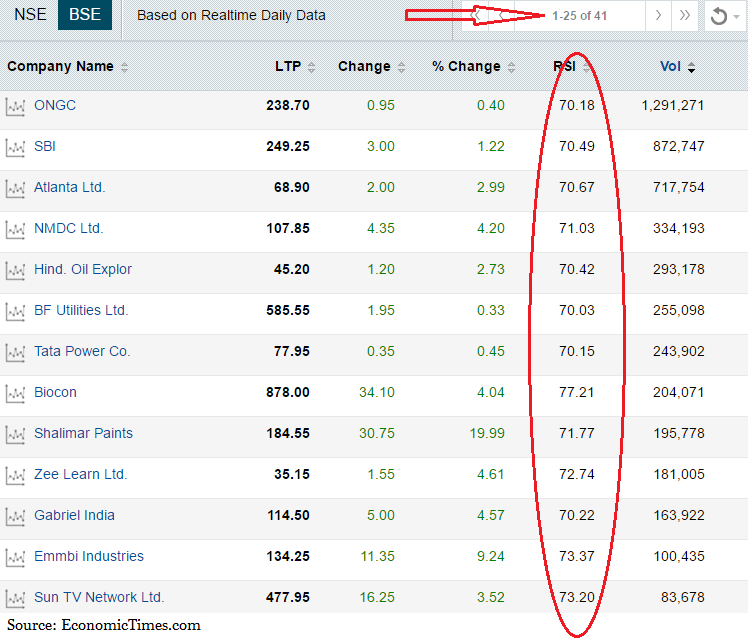

As the name suggests, when market is overbought, the buying has been excessive and we can expect the price to make a downward correction or a reversal. Typical Interpretation of Overbought and Oversold LevelsCommon way of looking at oscillators and their overbought and oversold areas is to think of them as a signal to trade in the other direction. Conversely, an oversold market occurs when sellers have prevailed and pushed the price down. Market is overbought when there has been “too much” buying in the recent past (last few price bars). Stocks with high RSI values can be interpreted as having overbought positions stocks with low RSI values can be.Most oscillators including RSI work with so called overbought and oversold areas. Overbought and Oversold Areas on OscillatorsRSI is an overbought-oversold indicator.

Recent price bars have made mostly lower closes, as the bears have had more strength. When RSI is below 20, the market is oversold. This typically happens in an uptrend, when the bulls have more power than the bears. Based on the calculation of RSI, high values of RSI occur when most of the recent bars have made higher closes (always compared to the previous bar). When RSI is greater than 80, it signals overbought market. Neither buying nor selling has pushed prices to one side or the other, and recent price action has been more or less sideways.

Trading RSI Overbought and Oversold LevelsThe common approach is to buy when oversold and sell when overbought. Generally, the lower border for oversold and higher border for overbought area you choose, the less frequently the market will get behind them and the less trading signals your RSI will give. You can use anything you like (even 17.8 and 82.2).

While the simplest trading systems which you can find everywhere in books and on the internet (and in this article) are less likely to give you consistently profitable results, you can take them as a starting point for your own research and dig deeper into RSI and its behaviour under various market conditions. It is very simple by itself, but provides endless possibilities regarding design of trading strategies. How to Build a Trading Strategy with RSIRSI is just one line oscillating between 0 and 100. Again, there are numerous options where to actually exit within the overbought or oversold area and what exact rules to follow. RSI Overbought / Oversold for Exiting TradesRSI overbought and oversold areas can also be used as a signal to exit from part or the whole position.

0 kommentar(er)

0 kommentar(er)